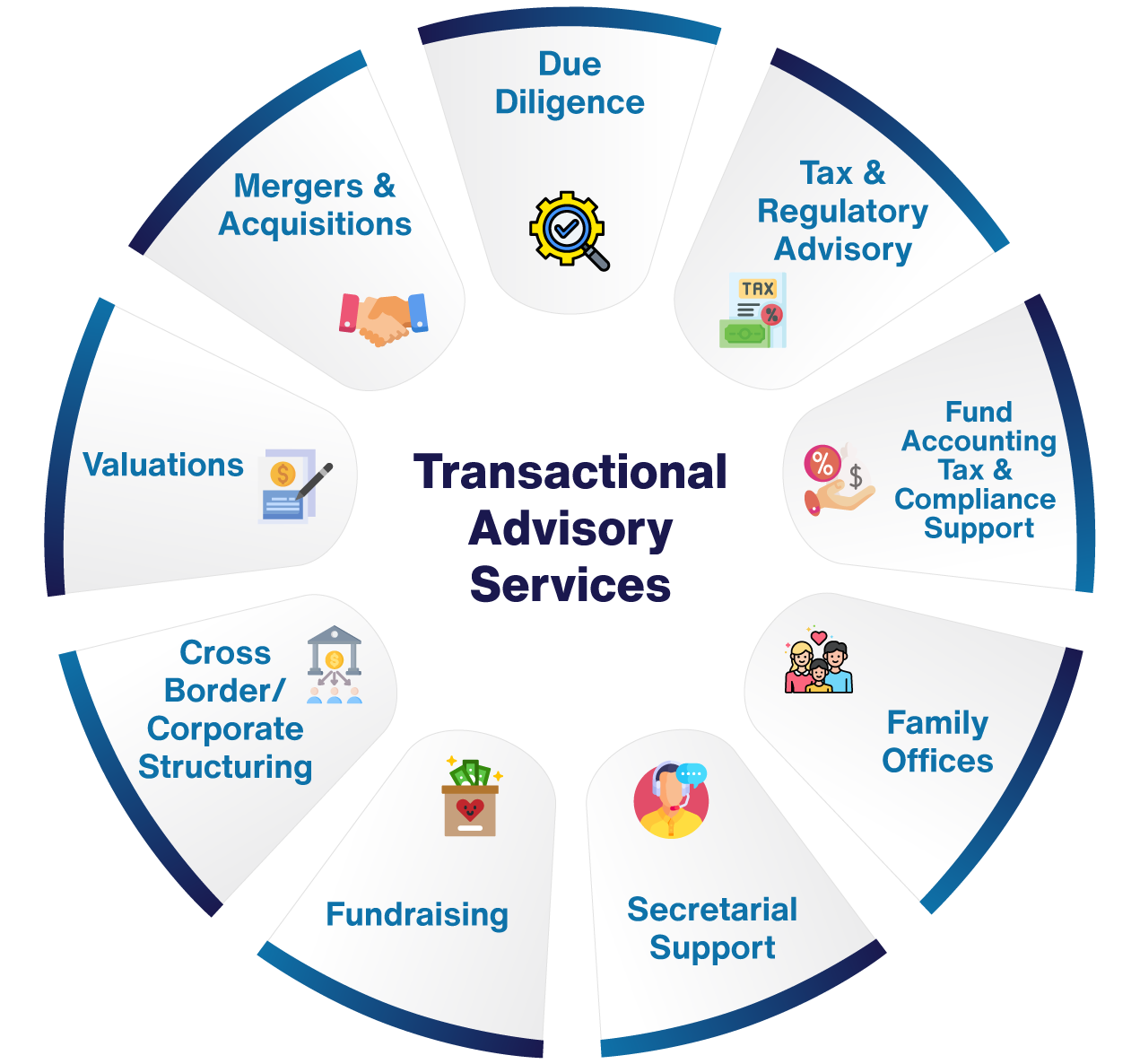

The Greatest Guide To Transaction Advisory Services

Wiki Article

Excitement About Transaction Advisory Services

Table of Contents5 Simple Techniques For Transaction Advisory Services4 Simple Techniques For Transaction Advisory ServicesTop Guidelines Of Transaction Advisory ServicesSome Known Questions About Transaction Advisory Services.The Definitive Guide for Transaction Advisory Services

This action makes certain business looks its finest to prospective purchasers. Getting the organization's value right is essential for an effective sale. Advisors make use of different methods, like discounted capital (DCF) evaluation, contrasting with comparable business, and recent transactions, to figure out the fair market price. This helps establish a fair rate and work out efficiently with future customers.Deal experts step in to assist by obtaining all the required details organized, responding to inquiries from customers, and setting up check outs to the business's area. Deal consultants utilize their expertise to assist organization owners manage tough settlements, fulfill buyer expectations, and framework bargains that match the owner's goals.

Fulfilling legal guidelines is essential in any business sale. They assist service owners in planning for their next steps, whether it's retired life, starting a new venture, or managing their newly found wide range.

Transaction advisors bring a riches of experience and expertise, making sure that every facet of the sale is handled expertly. Through tactical preparation, evaluation, and arrangement, TAS aids local business owner achieve the greatest feasible sale cost. By guaranteeing legal and governing compliance and managing due persistance together with other bargain staff member, purchase consultants minimize possible dangers and liabilities.

Transaction Advisory Services Things To Know Before You Get This

By comparison, Large 4 TS groups: Work with (e.g., when a prospective purchaser is performing due persistance, or when an offer is closing and the purchaser needs to integrate the company and re-value the vendor's Annual report). Are with costs that are not connected to the offer closing successfully. Earn costs per involvement someplace in the, which is less than what investment banks gain also on "little deals" (but the collection chance is additionally a lot higher).

The meeting questions are really similar to investment financial interview concerns, yet they'll focus a lot more on accounting and assessment and much less on topics like LBO modeling. For instance, anticipate questions regarding what the Adjustment in Capital methods, EBIT vs. EBITDA vs. Net Earnings, and "accounting professional just" topics like trial balances and exactly how to go through events using debits and credit ratings rather than monetary declaration adjustments.

Indicators on Transaction Advisory Services You Should Know

that show exactly how both metrics have transformed based on products, networks, and customers. to evaluate the precision of management's previous forecasts., including aging, inventory by item, average degrees, and arrangements. to identify whether they're entirely fictional or somewhat credible. Professionals in the TS/ FDD groups may additionally talk to administration about every little thing above, and they'll create a thorough report with their searchings for at the end of the process., and the basic form looks like this: The entry-level role, where you do a great deal of information and monetary analysis (2 years for a promo from below). The next degree up; similar work, yet you obtain the even more interesting little bits (3 years for a promotion).

Particularly, it's difficult to obtain advertised past the Supervisor degree due to the fact that few people leave the job at that stage, and you need to start showing evidence of your capability to produce profits to breakthrough. Allow's begin with the hours and lifestyle since those are much easier to define:. There are periodic late nights and weekend work, but nothing like the frantic nature of financial investment financial.

There are cost-of-living changes, so expect reduced compensation if you're in a less view costly place outside significant monetary (Transaction Advisory Services). For all positions other than Partner, the base wage comprises the mass of the total settlement; the year-end bonus offer could be a max of 30% of your base pay. Often, the very best way to boost your earnings is to switch over to a different firm and bargain for a higher income and incentive

The smart Trick of Transaction Advisory Services That Nobody is Talking About

You might get involved in business growth, yet financial investment financial obtains extra difficult at this stage because you'll be over-qualified for Analyst roles. Corporate financing is still a choice. At this stage, you ought to just stay and make a run for a Partner-level role. If you want to leave, possibly relocate to a customer and execute their evaluations and due persistance in-house.The major trouble is that due to the fact that: You normally need to join another Huge 4 team, such as audit, and job there for a couple of years and after that move into TS, job there for a few years and after that move right into IB. And there's still no assurance of winning this IB role because it relies on your area, clients, and the working with market at the time.

Longer-term, there is likewise some risk of and due to the fact that examining a business's historical financial info is not specifically brain surgery. Yes, people will constantly require to be included, however with advanced innovation, lower head counts could possibly sustain client engagements. That stated, the Purchase Providers group defeats audit in terms of pay, work, and leave chances.

If you liked this article, you may be interested in analysis.

Fascination About Transaction Advisory Services

Develop sophisticated financial frameworks that assist in identifying the actual market worth of a company. Offer advisory job in relationship to service assessment to help in negotiating and rates frameworks. Discuss the most ideal type of the deal and the sort of consideration to use (cash, stock, gain out, and others).

Carry out assimilation planning to figure out the procedure, system, and organizational adjustments that might be needed after the bargain. Establish standards for integrating divisions, technologies, find this and organization processes.

pop over to this site

Determine potential reductions by reducing DPO, DIO, and DSO. Analyze the possible customer base, industry verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence supplies crucial insights right into the functioning of the company to be acquired worrying risk assessment and worth creation. Recognize short-term alterations to financial resources, financial institutions, and systems.

Report this wiki page